Tech company VERIDAPT combines agility and experience to provide transparency to an expanding roster of commodities firms

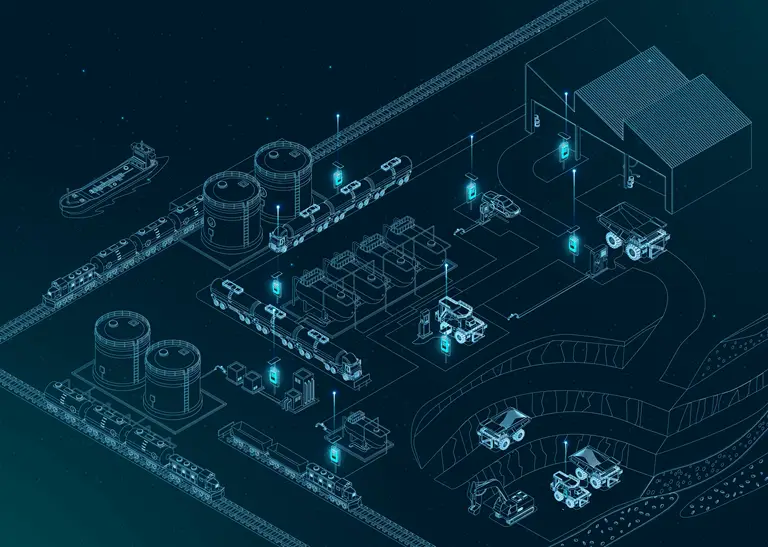

By bridging the divide between the physical and digital aspects of the commodities world, VERIDAPT is helping reduce risk across the commodities sector, according to Sean Birrell, chief technology officer (CTO) and co-founder of VERIDAPT. The digital verification platform provides industrials, banks, traders and other financiers with real-time monitoring of commodity supply chains, as well as supporting the growing need to manage carbon emissions.

In addition to reducing risk – such as physical risk to commodities or process risks around commodity finance transactions – the technology also enables greater transparency around transaction types that might rely on inspections or self-reporting models. “Structured commodity financing uses the underlying commodity as collateral to secure the deal,” explains David Thambiratnam, chief executive officer (CEO) of VERIDAPT. “Not having line of sight on the collateral can be quite risky, so they will often go to a lot of effort to send inspectors to monitor the asset and confirm quantity and quality.” The technology reduces the need for such inspections, increasing transparency for both bank and client, and uses real-time data to establish one version of ‘the truth’ about the asset.

For example, Macquarie started using Adapt Supply Chain Financing (AdaptSCF) – VERIDAPT’s remote Internet of Things real-time inventory monitoring and reconciliation platform – in July 2018 to support a diesel fuel purchase and storage agreement with a mining company in the Arctic Circle. Given the remote location of the mine, Macquarie can store fuel at the location and use the platform to monitor usage. Both the bank and the mining company are able to access the same inventory information via the platform to agree payment based on usage. As such, AdaptSCF helps satisfy Macquarie’s internal credit approval requirements for this deal and has also helped free up working capital for the mining company – rather than prepaying for a large amount of fuel, the client can pay as it is used.

VERIDAPT uses sensors in the field to collect real-time data on the underlying commodities to provide this service. This information is fed into a central platform that also offers execution and visualisation tools. The sensors used to gather data depend on the commodity type and location but can include flow meters or 3D scanning of stockpiles. “We collect that data and validate it against digital documents or other records and ledgers for reconciliation purposes,” Birrell explains.

During the second quarter of 2020, the company – then called FluidIntel – changed strategy as former CTO Thambiratnam took over as CEO. Working with Birrell, VERIDAPT developed a banking offering to sit alongside its existing mining and resources arm. As a result, VERIDAPT is currently in discussions with more than 20 major financiers and traders to provide supply chain financing deals, including floating vessel and terminal storage deals, as well as a refinery deal and fuel storage opportunity in China.

Birrell and Thambiratnam say this shift to address the banking sector marked the start of an “innovative trajectory” for VERIDAPT. It has since rolled out new technology-based solutions designed to reduce theft and fraud, while managing supply chain financing and emerging environmental goals.

“Our underlying strength is that we are using the same core product, so when we work with banks we can reassure them we’ve been around for 15 years and our technology is already used every day to monitor AU$5 billion worth of commodities,”

Thambiratnam says.

The company’s start-up mentality has also impressed banks, according to Birrell, particularly since he says it has allowed VERIDAPT to roll out new, tailored solutions in as little as three months. “We are willing to experiment and pilot solutions, particularly for emerging technologies, but we also look for a quick path to commercialisation,” Birrell adds. “That start-up agility is well received and we have found the banking industry to be very open to sharing its challenges and discussing new ideas."

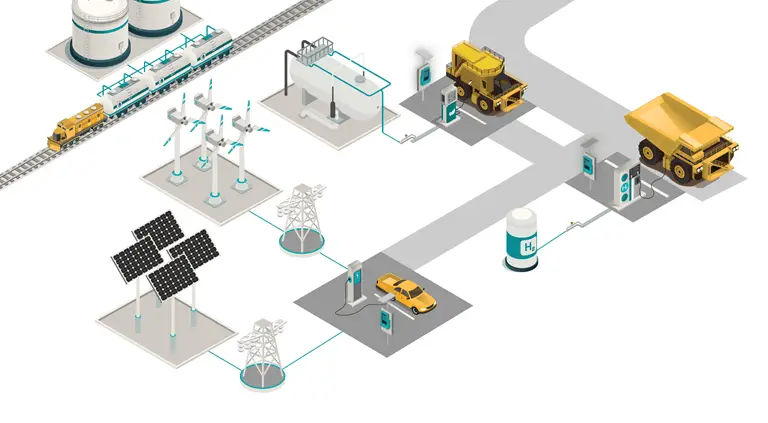

For many organisations in the commodities sector, a major emerging challenge is the need to satisfy stakeholders’ environmental concerns, particularly as the energy transition looms large. VERIDAPT has already responded by adding carbon emissions reporting capabilities to its platform. This supports customer efforts to offset emissions from production, transportation, storage and consumption of hydrocarbons through real-time monitoring and visibility of supply chains.

“As a cloud-based platform, we are constantly adding and iterating,” Birrell says. “And I think everyone understands the current environment in which commodity players are making net-zero commitments and banks are making statements around the kinds of businesses they will finance and the governance they expect from clients.”

Reporting accuracy is key here, but it creates an extra compliance burden. “Companies want to show they are meeting requirements or obligations linked to covenants, for example, which is going to require a lot of information exchange, although it’s currently at a very early stage,” Birrell says.

“Our core capability is to connect the physical to the digital,”

Thambiratnam continues. “And so, whether it’s ensuring emissions reporting is valid or reconciling $100 million-worth of bauxite sitting in a mine in the middle of China, we can help our clients to establish the truth about these assets.”